Want More Leads, Reviews, and Revenue in the Next 30 Days While Saving 100+ Hours Time? This System Does the Work While You Focus on Running Your Business

Without Working More Hours, Hiring Inhouse Team, or Guessing What Works

$10,000,000+ GENERATED FOR CLIENTS

here's a gift for you

Get A Complete Audit Report Worth $1000 For FREE Today!

Let us take a close look at your brand and competitors to see what they’re doing well and where you are falling short. We’ll find important insights about their strategies, strengths, and weaknesses.

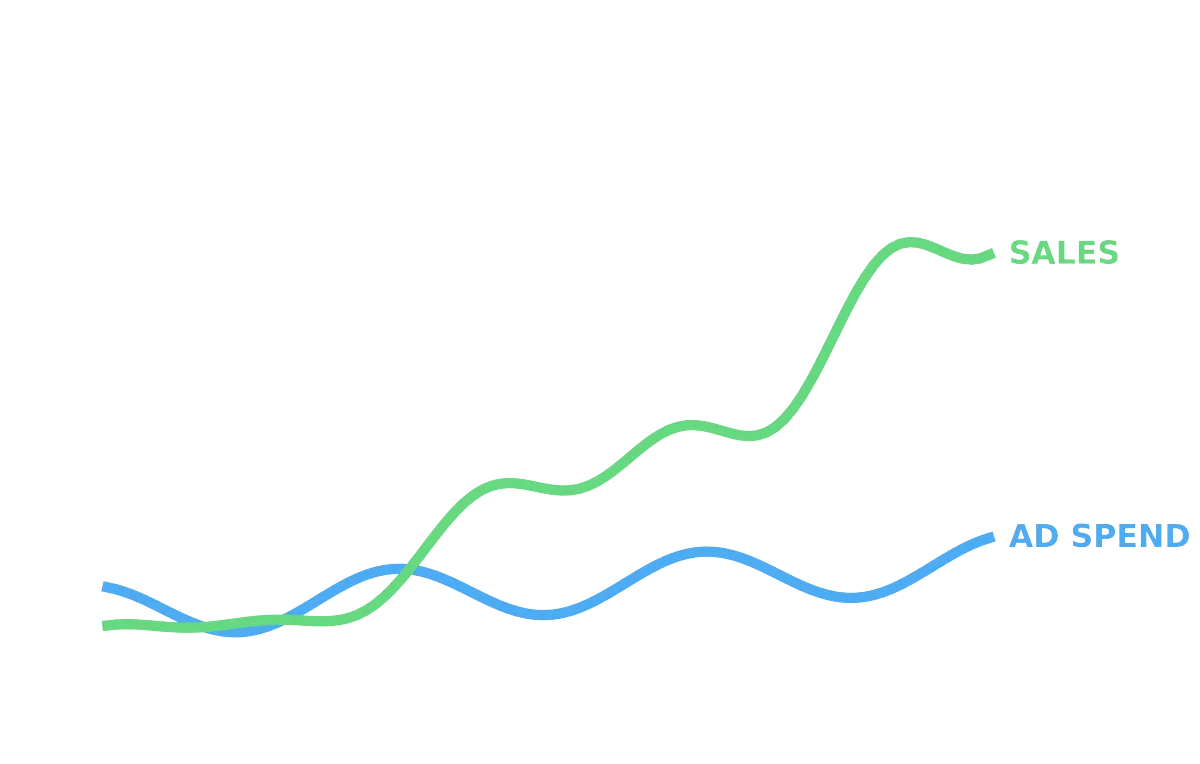

Where we scale your business

.webp)

Who's This Perfect For

BRANDS

LOCAL BUSINESSES

SURGERY CLINICS

AMAZON SELLERS

HAIR TRANSPLANT CLINICS

COSMETIC SUGEONS

Super Simple 3 Step Process

Book A Call & Start

Once you book a call and we meet your expectations, we can move forward with an agreement and begin the process.

Optimise Funnel & Ads

With this information, we’ll create the high converting sales funnel page and start ads right away with first 10 working days

Get Results Fast

Add us to your ad managers, and we'll take care of your ads, sales, and conversions to help you achieve the highest return.

Ready to get started?

What Our Clients Say About Working With Us

They have been very helpful and are always available whenever we needed help. As a new business owner, they ba given us a lot of guidance and taught us a lot about this skill. Will recommend anyone who needs mentorship to engage them!

Esther - Singapore

They go out the way to help us in our business. Most reliable and great team to work with. Thanks Firaas.

Carl - USA

This is how I would describe my experience with eBrandX! I was at the brink of desperation trying for months to get my ads up and running. Help offered from another source took me no where, but then I found eBrandX.

eBrandX did an amazing job sourcing a profitable product, finding a trustworthy supplier with a good deal, and making sure the product quality met the criteria expected. Whole process and management has been done efficiently and in a professional manner.

So, if you are looking for a professional and reliable team to help you out with this process, I highly recommend eBrandX. You will not be disappointed! THANK YOU eBrandX, I would not be where I am if it was not for you. Looking forward to working with you long term.

Nayely - USA

Last year I started my business with the help of EBrandX and I am extremely satisfied with their services.

They provided me with comprehensive support throughout the entire process, from setting up my account to scaling my business.

Their team of experts helped me understand the marketplace, optimize my product listings, and increase my sales through effective marketing strategies.

I highly recommend EBrandX to anyone looking to start or grow their business through Google ads. Their expertise and commitment to their clients' success is unmatched. Thank you Team!

Nathan - USA

I had the pleasure of working with ebrandX for setting up our business, and I must say, their services and professionalism are truly exceptional. From the very beginning, they were with us every step of the way, offering expert guidance and support.

ebrandX's team displayed a remarkable level of expertise. They not only helped us navigate the complexities of setting up our store but also provided invaluable insights into optimizing our product listings, managing inventory, and leveraging advertising tools.

Furthermore, the professionalism exhibited by the ebrandX team was outstanding. They were always responsive to our queries and concerns, ensuring a smooth and efficient process.

In conclusion, ebrandX is a top-notch company that I wholeheartedly recommend to anyone looking to establish a successful presence on Amazon. Their expertise, dedication, and professionalism are truly commendable. Thank you, ebrandX, for your exceptional services!

Kalpana - USA

I highly recommend eBrandX. Very professional and trustworthy. Very helpful with my questions. Took care of basically staring the business . From sourcing to marketing. Amazing. What a good experience I had with them. Will for sure work with them again. Will rate 10+ scale of 0-10. Impressive

Judith - USA

I advise dealing with them well and thank them for their kind treatment and constant assistance without hesitation

Majd - USA

My Experience with eBrandX is so far very good, they have professional teams who are always there to answer to my queries, no ifs or buts from them! I am very happy with the services I have received, and will continue to receive thier services to build my brand. Highly reommmened!

Jawad - Canada

The team are professional and helpful with their immense knowledge of sourcing great products . They are understanding and work with you as a team to get things done. They are genuine and want their clients to succeed. We truly thank them. Looking forward to working with the team again.

Glow Ventures - UK

eBrandX is a professional company that has a vast knowledge and experience. They are a professional team that have answers to any of my questions and always deliver great results. I highly recommend working with them.

Nick - USA

eBrandX has always been always ready to help me, partner with me and help make me successful. In honesty when I started out with starting my store, I wouldn't have been where I am today without eBrandX, they are thoroughly professional and honest.

Saad - USA

Firaas and team worked with me since day one. I just started my LLC company and don’t know where to go. Firaas talked to me more than 1 hour for few days and clarified all my doubts. Really knowledgeable person and he has great hard working team. Really appreciate their work and looking forward to work with them in long term. They are genuinely care about the products they search. Gave me honest opinions about my suggestions and guided me in right way. It is not 1 day or 1 week job but need lot of patience to find a right product.

Sreenivas - USA

Great team, very helpful. They have a lot of knowledge about this business and will help you with anything related Google ads.

Raul - USA

Their team is very professional and helpful. I faced unexpected problems as a new business owner. They gave me solutions to solve the problems. Highly recommended.

Maria - Italy

I worked with them, they are very professional, attentive and ready to help. they helped me a lot to manage my account, I highly recommend

Sadouni - Canada

What a great work. I love the way they complete projects. They are quite professional, skilled and target oriented. I highly recommend ecommerce brands. I will again work with them.

Sam - Canada

ebrandX team helped me launch my first successful product 😀, since then we have moved on two different avenues and planning to work for a long term. He's very honest and reliable along with his dedicated team that takes care of every problem or issues you would face running e-commerce business. I couldn't recommend ebrandX highly enough. You are in safe hands take my word for it.

Dave - UK

It's been a very helpful and informative experience. EBrandX has been very professional and methodical in taking my ecommerce business to the next stage.

Thanks so much for everything.

Marie - UK

I couldn’t of done it without the help from eBrandX. They have been amazing from the start and I have learnt so much.

I couldn’t have launched my 1st product without their help.

I would highly recommend them to anyone who is considering a career in e-commerce.

Kerry - UK

It was pleasant experience working with eBrandX. This team knows exactly what to do to satisfy the customer's needs. Looking forward to work with you again.

Thank you eBrandX!

Razia - USA

Great company. I highly recommend Firass and his services..5 star all the way.

Cindy - USA

I have experienced a high quality service. I have always found them responsive and come with a quick solution. They really know what they are doing and no time I have needed any stress while working with them.

Esre Trade - Turkey

Firaas has so much knowledge when it comes to generating sales. He is so helpful and really knows how to help you succeed with ads. I highly recommend him

Alona - USA

They work with me to manage my account. They saved my time and now I have helping hand to handle the day to day management in the right way.

Herbert - USA

I find his work to be professional and knowledgeable on all subject areas. Very responsive and provides a great working partnership and communication with a joint interest to reach the same goal

Henry - UK

Guys, you have been so awesome so far!

I want to thank you for being so kind and professional in the world we live in now!!

Eliza - USA

STILL NOT SURE?

Frequently Asked Questions

We understand you may have questions

Question 1: Do you guarantee results?

Yes, we do. We offer full money back guarantee if you dont get desired results - its full risk free commitment

Question 2: What do you offer that others don't?

Guaranteed results or you don't pay plus we offer some surprise bonuses that others don't offer

Question 3: When can I exepect results when I buy?

As soon as we complete our analysis and start campaigns

Question 4: What's the mode of communication?

We have account managers, communication managers and supervisors to keep track of progress. We will track it and communicate on Clickup.

Want to work with us?

Book a call, and if we meet your expectations, we’ll get started with a simple agreement and launch your high converting funnels fast and ads for real results.

EBRANDX LLC,

5830 E 2nd St, Ste 7000 #22142, Casper, Wyoming 82609 US

+1 (347)-354-1971

Proud Member Of American Marketing Association

COMPANY

OUR SERVICES

WHO WE SERVE

75K+ Community & Growing

Copyright 2025. eBrandX. All Rights Reserved.

Facebook

Instagram

LinkedIn

Facebook